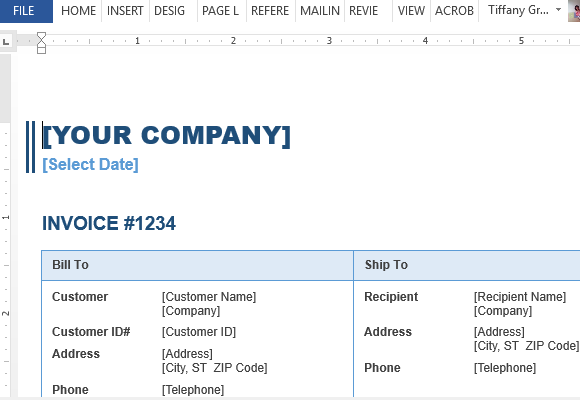

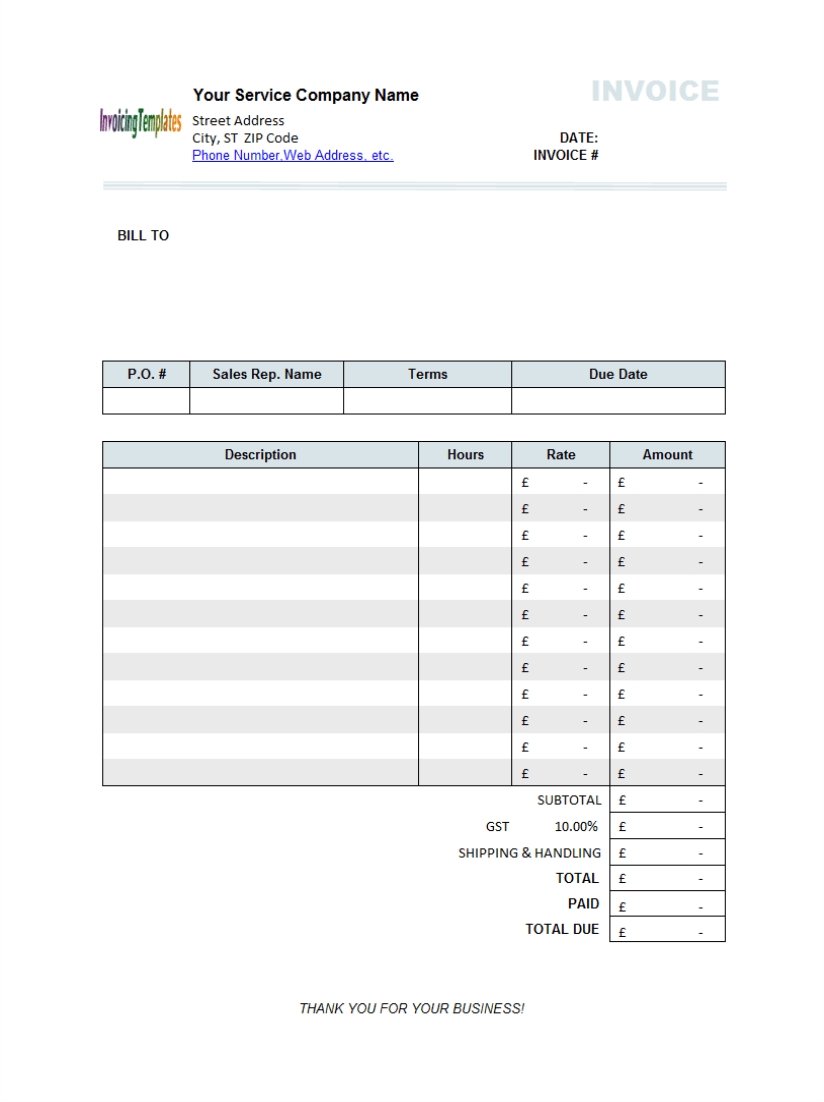

After past due, the client must be pursued to have the unpaid invoice paid. This might be problematic for any business as it affects cash flow. The unpaid invoice is regarded as past-due if the deadline has passed and the client hasn’t sent the payment. There is a payment deadline listed on your invoice. What is a Past Due Invoice?Īfter establishing an outstanding invoice, the concept of a past-due invoice has now been established. You refer to an invoice as an outstanding invoice from the time it is sent to the client until payment has been received as it is simply outstanding for payment. While the client needs all of this information, the payment deadline is crucial to be added to an invoice. Your invoice should include the amount due, the due date, the acceptable payment methods , and the invoice number. Payment conditions specify when the client must pay the company. The payment conditions determine how long an invoice is past due. It is past due the moment you send the invoice to the client. In this article, we will walk you through what an outstanding invoice is and how can you settle them on time with time-tested measures: What is an Outstanding Invoice?Īn outstanding invoice is an unpaid invoice that is sent to a client and has not been paid yet.

So, how can you manage outstanding payments without causing a rift with your clients and keeping cash flow steady?

When dealing with unpaid and past due invoices, exercising caution is critical to prevent late payments and jeopardizing your company relationships while seeking payment for what is owed. Many businesses require the ability to manage past-due accounts and persuading customers to make timely payments is critical to your company’s success. According to a report conducted by US Bank, insufficient cash flow management causes 82% of many small businesses and enterprises to fail.

0 kommentar(er)

0 kommentar(er)